Accounting Solutions

For Everyday People

Doing Extraordinary Things

Tax Planning

You Can TRUST

Homeowner and Condo

Association Specialists

Non-Profit

Partners

2023 Electric/clean vehicle tax credit

If you place in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a clean vehicle tax credit.

- $3,750 if the vehicle meets the critical minerals requirement only

- $3,750 if the vehicle meets the battery components requirement only

- $7,500 if the vehicle meets both

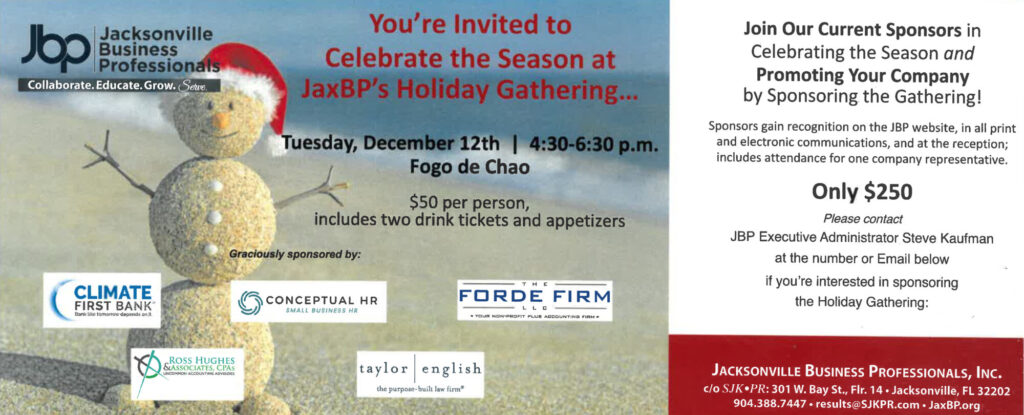

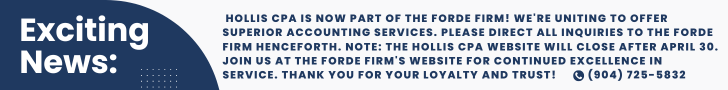

The Forde Firm is the business and non-profit accounting firm of choice in the North East Florida area.

Let us tackle your most complex tax issues and strategize to achieve your goals. We are current on the latest tax and audit laws, and are prepared to assist you, as well as represent you, with the IRS, or other state agencies. We can replace your back office with accounting, payroll, and bookkeeping support.

With our specialization in Non-Profit entities, we are able to ensure that your books and records are as they should be for donors, grantors and clients.

We have the network and resources to connect you with the team to help get things done! We also have the expertise to prepare your personal returns as well as help you with financial planning.

As a veteran-owned and woman-owned business we bring a unique perspective to your finances that allows us to advise you on high value accounting and tax services so you can make your business successful.

YOUR

DIVERSE TEAM

YOUR

PARTNERS

YOUR

ACCOUNTING FIRM

BUSINESS JOURNAL

BLOG

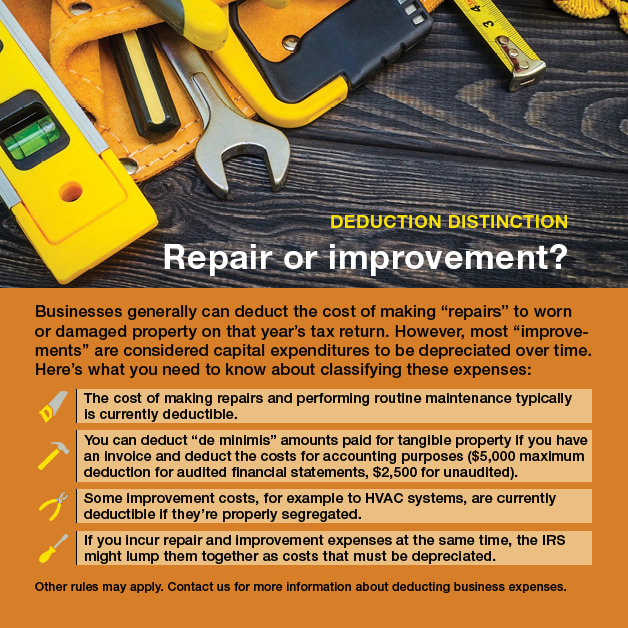

Tax Court Ruling about expenses and deductions.

A recent tax court ruling landed in favor of the IRS. The court ruled that paying or incurring an expense is not sufficient to entitle

Fair Labor Standards Act Update and the Independent Contractor Final Rule

On January 10, 2024, the U.S. Department of Labor published a final rule, effective March 11, 2024, revising the Department’s guidance on analyzing who is

What is beneficial ownership interest and what does it mean for my business.

You may have heard recently that almost all businesses have a new reporting requirement and that it is due January 1, 2024. While that is

Stay in Touch

Services

Fully ADA compliant

Hours

Monday - Friday: 8am - 5pm

Saturday: By appointment

Sunday: Closed